Everybody wants to save a buck. We use Groupon to get better deals at restaurants and never return there again. We share Netflix user names because why pay $15 a month when we can get that for free?

Not you, though. Everyone else does that.

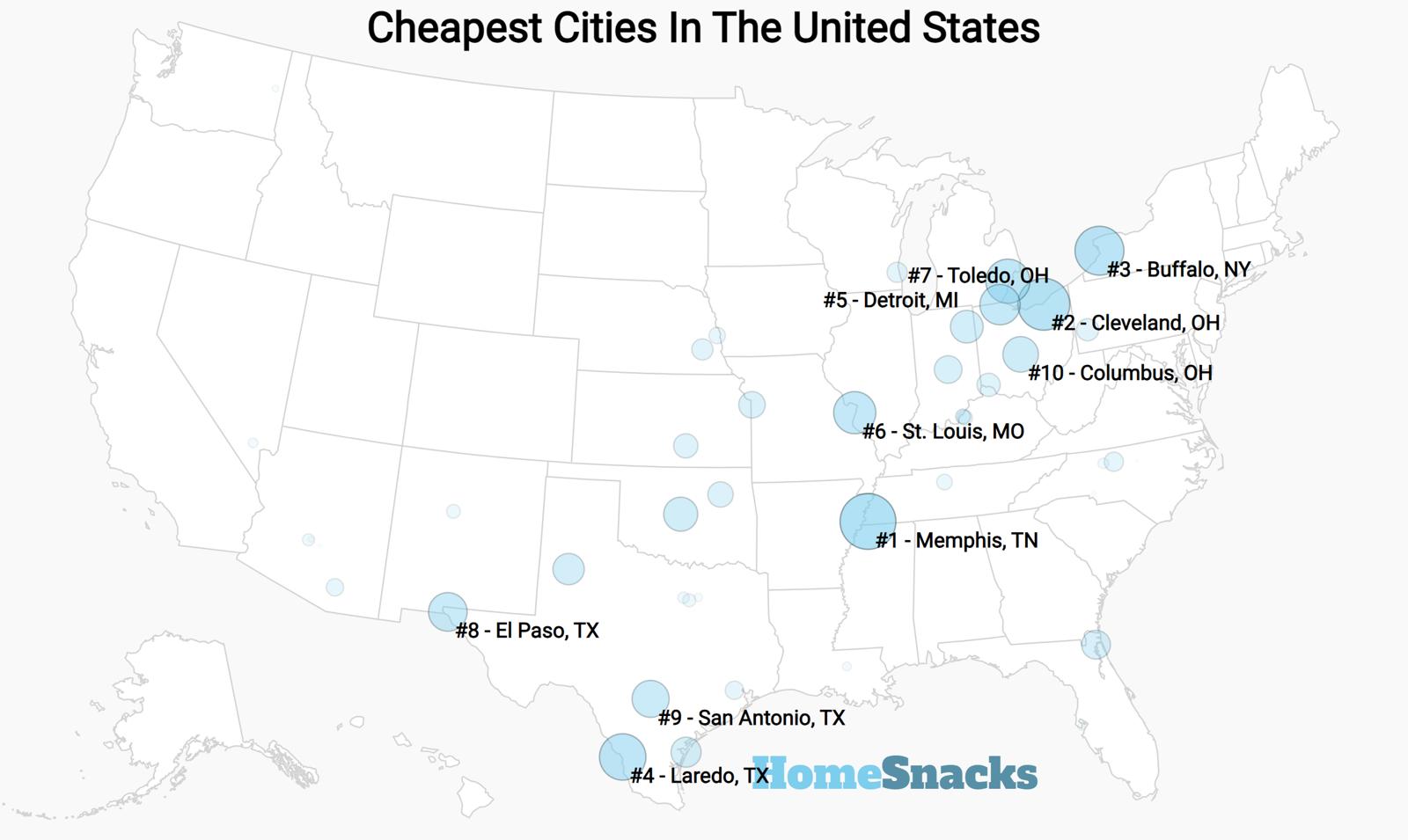

Today, we will talk about the cheapest cities in the United States. Now, by cheap, we’re referring to the cost of living in these places. So, if you’re a cheapskate, you’d fit right in. Ideally, people want to move to cheap cities to afford to live without stress.

How do we define ‘cheap’ anyway? While we can’t tell if a population is generous or not, we can use Saturday Night Science to compare the cost of living across cities. A big portion of that is housing costs, but things like healthcare, groceries, and utilities also play a role.

Table Of Contents: Top Ten | Methodology | Summary | Table

The 10 Cheapest Cities To Live In The United States For 2024

What’s the cheapest city to live in America? According to the most recent data, Memphis, TN ranks as the cheapest city in America. And San Francisco, CA ranks as the most expensive American city.

Some people are just fine with cheap living. If that’s you, then pay attention.

Turn up the volume on your outdated phones and laptops as we bring you America’s cheapest cities. To see exactly how we calculated these rankings, read on.

Or if you’re not interested in reading about saving a buck, check out:

The 10 Most Affordable Cities In The United States For 2024

/10

Population: 630,027

Cost Of Living Index: 80

Median Income: $48,090

Home Prices: $144,868

Home Price To Income Ratio: 3.0x (4th most affordable)

More on Memphis: Data | Crime | Cost Of Living | Real Estate

Very low cost of housing and no state income taxes are big advantages. Some surrounding communities have low crime and have good public schools, be careful of the local community and who you know. Not too unfriendly but fear new ideas, creativity and mistrust new people and anyone complaining about moving in to leave bad areas because of fear what would say about them. Somewhat luddite and expensive to fly in and out as Delta abandoned their hub in the small airport which is not international is keeping people out along with the reputation of the more dangerous localized areas and they’re relatively mistrusting while liberal in and near the city in a conservative state. The issues are being worked on by the new Governor and big companies such as just opening a new facility in historic but areas in need.

Good is no state income tax and low cost of housing with low property taxes and some nice areas. Bad is high cost of flights, need to be careful about where to live and go.

/10

Population: 370,365

Cost Of Living Index: 80

Median Income: $37,271

Home Prices: $100,343

Home Price To Income Ratio: 2.7x (3rd most affordable)

More on Cleveland: Data | Crime | Cost Of Living | Real Estate

I have lived in Cleveland, OH for five years now and I enjoy the many attractions there are including sporting events, downtown, variety of food places, and the night scene.

Downtown Cleveland, University Circle, and Little Italy are my top 3 favorite places in Cleveland. The things I do not like about Cleveland are the brutal winters due to the lake effect and crime rate in certain areas.

/10

Population: 276,688

Cost Of Living Index: 80

Median Income: $46,184

Home Prices: $215,169

Home Price To Income Ratio: 4.7x (40th most affordable)

More on Buffalo: Data | Crime | Cost Of Living | Real Estate

Great time bars are open till 4 and the architecture is amazing. Frank Lloyd Wright did a lot in the city. And it’s home to the best dive bar in the state, the pink!

The pink, canal side, bills game tailgating, Allen street, elmwood village

/10

Population: 255,293

Cost Of Living Index: 83

Median Income: $60,928

Home Prices: $206,477

Home Price To Income Ratio: 3.4x (10th most affordable)

More on Laredo: Data | Crime | Cost Of Living | Real Estate

/10

Population: 636,787

Cost Of Living Index: 84

Median Income: $37,761

Home Prices: $66,544

Home Price To Income Ratio: 1.8x (most affordable)

More on Detroit: Data | Crime | Cost Of Living | Real Estate

Despite the downfalls the city has/is facing it is still a place full of culture and history. I LOVE the fact that they are so sports orientated. I grew up being a huge fan of sports and there is no bigger sports town than Detroit. Redwings, Pistons, Tigers and Lions are all supported with large amounts of pride!

Joe Louis Arena, Comerica Park, the new football and hockey arenas. The hockeytown cafe all the casinos and the theater. There is so much history and so much pride in the historical places still!

/10

Population: 298,018

Cost Of Living Index: 84

Median Income: $52,941

Home Prices: $168,569

Home Price To Income Ratio: 3.2x (8th most affordable)

More on St. Louis: Data | Crime | Cost Of Living | Real Estate

Being in a new place is so different,everything is different but the people are great. I got tot meet some really good people along the way.

Of course the Arch stands out more than anything else in St. Louis. There is no bad side to it at all

/10

Population: 269,962

Cost Of Living Index: 85

Median Income: $45,405

Home Prices: $114,512

Home Price To Income Ratio: 2.5x (2nd most affordable)

More on Toledo: Data | Crime | Cost Of Living | Real Estate

/10

Population: 677,181

Cost Of Living Index: 87

Median Income: $55,710

Home Prices: $213,288

Home Price To Income Ratio: 3.8x (20th most affordable)

More on El Paso: Data | Crime | Cost Of Living | Real Estate

/10

Population: 1,445,662

Cost Of Living Index: 88

Median Income: $59,593

Home Prices: $257,552

Home Price To Income Ratio: 4.3x (33rd most affordable)

More on San Antonio: Data | Crime | Cost Of Living | Real Estate

San Antonio just offers a higher quality of life than other cities in Texas. Good for Family and business.

We love the climate if you can withstand the hot summers where temp reach 100F or above on some days mainly in July and August.

/10

Population: 902,449

Cost Of Living Index: 88

Median Income: $62,994

Home Prices: $237,662

Home Price To Income Ratio: 3.8x (19th most affordable)

More on Columbus: Data | Crime | Cost Of Living | Real Estate

Crime is fairly low, cost of living is low, good job market

Thurmans, hound dogs pizza, columbus zoo, nationwide arena, records per minute, lost weekend records

Methodology: How We Determined The Most Affordable Large Cities in The US For 2024

The two most important things to think about when it comes to being able to afford if you can live comes down to:

- How much do money do I make?

- How much do I have spend to live there?

You need to understand your costs in the context of how much money you make.

For example, if the median household earns $100,000 and spends $40,000 on housing it’s actually cheaper to live there than a place with a median income of $50,000 and housing costs of $21,000. You might spend more on housing, but you have more money overall to play with.

With that example in mind, we derived several statistics from the latest Census American Community Survey 2018-2022 around incomes and Zillow for home prices. They are:

- Median Home Price / Median Income (lower is better)

- Median Income / Median Rent (Higher is better)

- Cost of living index

We added simply median home price because high home prices generally correlate with higher expenses for all costs related to homes (heating, electricity, etc).

What you are left with is a “Cost of Living Index” by taking the average rank of each of these metrics for each city.

So we used that cost of living index in order to rank all of the 100 largest cities in the US. We updated this article for 2024. This is our tenth time ranking the cheapest places to live in America.

The place with the lowest cost of living in America according to the data is Memphis, TN.

Summary: The Cheapest Big Cities in America

Okay, there ya go. Our cheapest cities in the USA. The places where you can live the most comfortably on your income. After measuring every cost of living factor that makes sense, there isn’t a clear ‘region’ that has the advantage for cheap living.

The cities in the United States with the lowest cost of living are Memphis, TN, Cleveland, OH, Buffalo, NY, Laredo, TX, Detroit, MI, St. Louis, MO, Toledo, OH, El Paso, TX, San Antonio, TX, and Columbus, OH.

And while this is good news for the places we mentioned, if you happen to live in Yonkers, NY, Jersey City, NJ or San Francisco, CA, you’re probably head over heels in living expenses.

So we hoped you learned something. We did. The next time you’re in over your head with bills, wondering why you paid all that money for a worthless college degree and lamenting that new car purchase you just made, remember this: You could always move somewhere in the midwest. No? Okay.

Here’s a look at the most expensive cities in America:

- San Francisco, CA

- Fremont, CA

- Irvine, CA

For more reading, check out:

Cheapest Cities In The US For 2024

| Rank | City | Population | Cost Of Living Index | Median Income | Average Home Price | Home/Income Ratio |

|---|---|---|---|---|---|---|

| 1 | Memphis, TN | 630,027 | 80 | $48,090 | $144,868 | 3.0x |

| 2 | Cleveland, OH | 370,365 | 80 | $37,271 | $100,343 | 2.7x |

| 3 | Buffalo, NY | 276,688 | 80 | $46,184 | $215,169 | 4.7x |

| 4 | Laredo, TX | 255,293 | 83 | $60,928 | $206,477 | 3.4x |

| 5 | Detroit, MI | 636,787 | 84 | $37,761 | $66,544 | 1.8x |

| 6 | St. Louis, MO | 298,018 | 84 | $52,941 | $168,569 | 3.2x |

| 7 | Toledo, OH | 269,962 | 85 | $45,405 | $114,512 | 2.5x |

| 8 | El Paso, TX | 677,181 | 87 | $55,710 | $213,288 | 3.8x |

| 9 | San Antonio, TX | 1,445,662 | 88 | $59,593 | $257,552 | 4.3x |

| 10 | Columbus, OH | 902,449 | 88 | $62,994 | $237,662 | 3.8x |

| 11 | Oklahoma City, OK | 681,088 | 88 | $64,251 | $195,449 | 3.0x |

| 12 | Fort Wayne, IN | 264,514 | 88 | $58,233 | $216,656 | 3.7x |

| 13 | Lubbock, TX | 258,190 | 88 | $58,734 | $204,713 | 3.5x |

| 14 | Corpus Christi, TX | 317,804 | 89 | $64,449 | $216,357 | 3.4x |

| 15 | Jacksonville, FL | 950,203 | 90 | $64,138 | $293,086 | 4.6x |

| 16 | Indianapolis, IN | 882,006 | 90 | $59,110 | $218,415 | 3.7x |

| 17 | Kansas City, MO | 505,958 | 90 | $65,256 | $227,993 | 3.5x |

| 18 | Tulsa, OK | 411,938 | 90 | $56,648 | $192,607 | 3.4x |

| 19 | Wichita, KS | 395,951 | 90 | $60,712 | $183,706 | 3.0x |

| 20 | Cincinnati, OH | 308,870 | 90 | $49,191 | $235,782 | 4.8x |

| 21 | Pittsburgh, PA | 303,843 | 90 | $60,187 | $224,210 | 3.7x |

| 22 | Lincoln, NE | 290,531 | 90 | $67,846 | $267,971 | 3.9x |

| 23 | Milwaukee, WI | 573,299 | 91 | $49,733 | $191,843 | 3.9x |

| 24 | Greensboro, NC | 297,202 | 91 | $55,051 | $248,523 | 4.5x |

| 25 | Houston, TX | 2,296,253 | 93 | $60,440 | $260,901 | 4.3x |

| 26 | Tucson, AZ | 541,033 | 93 | $52,049 | $324,757 | 6.2x |

| 27 | Omaha, NE | 489,201 | 93 | $70,202 | $268,796 | 3.8x |

| 28 | Nashville, TN | 684,103 | 94 | $71,328 | $428,714 | 6.0x |

| 29 | Louisville, KY | 629,176 | 94 | $63,114 | $231,566 | 3.7x |

| 30 | Albuquerque, NM | 562,551 | 94 | $61,503 | $321,089 | 5.2x |

| 31 | Arlington, TX | 393,469 | 94 | $71,736 | $312,016 | 4.3x |

| 32 | Glendale, AZ | 248,083 | 94 | $66,375 | $405,468 | 6.1x |

| 33 | Fort Worth, TX | 924,663 | 95 | $72,726 | $303,501 | 4.2x |

| 34 | Winston-Salem, NC | 249,571 | 95 | $54,416 | $241,673 | 4.4x |

| 35 | North Las Vegas, NV | 264,022 | 96 | $71,774 | $385,939 | 5.4x |

| 36 | Baton Rouge, LA | 225,500 | 96 | $50,155 | $214,487 | 4.3x |

| 37 | Dallas, TX | 1,300,642 | 97 | $63,985 | $306,310 | 4.8x |

| 38 | St. Petersburg, FL | 259,343 | 97 | $70,333 | $375,897 | 5.3x |

| 39 | Spokane, WA | 227,922 | 97 | $63,316 | $374,653 | 5.9x |

| 40 | Phoenix, AZ | 1,609,456 | 98 | $72,092 | $417,187 | 5.8x |

| 41 | Philadelphia, PA | 1,593,208 | 98 | $57,537 | $216,286 | 3.8x |

| 42 | Charlotte, NC | 875,045 | 98 | $74,070 | $387,529 | 5.2x |

| 43 | Mesa, AZ | 503,390 | 98 | $73,766 | $431,607 | 5.9x |

| 44 | Durham, NC | 284,094 | 98 | $74,710 | $395,610 | 5.3x |

| 45 | St. Paul, MN | 308,806 | 99 | $69,919 | $278,672 | 4.0x |

| 46 | Las Vegas, NV | 644,835 | 100 | $66,356 | $399,875 | 6.0x |

| 47 | Irving, TX | 254,962 | 100 | $76,686 | $337,139 | 4.4x |

| 48 | Tampa, FL | 388,768 | 101 | $66,802 | $391,344 | 5.9x |

| 49 | New Orleans, LA | 380,408 | 101 | $51,116 | $253,741 | 5.0x |

| 50 | Orlando, FL | 307,738 | 101 | $66,292 | $373,263 | 5.6x |

| 51 | Raleigh, NC | 465,517 | 102 | $78,631 | $431,992 | 5.5x |

| 52 | Aurora, CO | 387,349 | 102 | $78,685 | $472,149 | 6.0x |

| 53 | Norfolk, VA | 236,973 | 102 | $60,998 | $284,301 | 4.7x |

| 54 | Richmond, VA | 227,171 | 103 | $59,606 | $328,655 | 5.5x |

| 55 | Hialeah, FL | 222,996 | 103 | $49,531 | $445,753 | 9.0x |

| 56 | Baltimore, MD | 584,548 | 104 | $58,349 | $179,189 | 3.1x |

| 57 | Minneapolis, MN | 426,877 | 104 | $76,332 | $318,812 | 4.2x |

| 58 | Reno, NV | 265,196 | 105 | $73,073 | $526,202 | 7.2x |

| 59 | Garland, TX | 244,026 | 105 | $71,044 | $297,145 | 4.2x |

| 60 | Atlanta, GA | 494,838 | 106 | $77,655 | $379,030 | 4.9x |

| 61 | Madison, WI | 268,516 | 106 | $74,895 | $369,136 | 4.9x |

| 62 | Austin, TX | 958,202 | 107 | $86,556 | $533,213 | 6.2x |

| 63 | Henderson, NV | 318,063 | 107 | $85,311 | $461,416 | 5.4x |

| 64 | Colorado Springs, CO | 479,612 | 108 | $79,026 | $440,298 | 5.6x |

| 65 | Chandler, AZ | 275,618 | 109 | $99,374 | $519,175 | 5.2x |

| 66 | Enterprise, NV | 225,461 | 109 | $91,165 | $463,796 | 5.1x |

| 67 | Fresno, CA | 541,528 | 110 | $63,001 | $363,927 | 5.8x |

| 68 | Newark, NJ | 307,355 | 110 | $46,460 | $432,693 | 9.3x |

| 69 | San Bernardino, CA | 221,041 | 111 | $61,323 | $455,364 | 7.4x |

| 70 | Denver, CO | 710,800 | 112 | $85,853 | $558,402 | 6.5x |

| 71 | Gilbert, AZ | 267,267 | 112 | $115,179 | $566,231 | 4.9x |

| 72 | Chesapeake, VA | 249,377 | 112 | $92,703 | $374,172 | 4.0x |

| 73 | Chicago, IL | 2,721,914 | 113 | $71,673 | $283,025 | 3.9x |

| 74 | Virginia Beach, VA | 457,900 | 114 | $87,544 | $384,137 | 4.4x |

| 75 | Miami, FL | 443,665 | 114 | $54,858 | $569,425 | 10.4x |

| 76 | Stockton, CA | 320,030 | 114 | $71,612 | $428,288 | 6.0x |

| 77 | Bakersfield, CA | 404,321 | 115 | $73,827 | $377,282 | 5.1x |

| 78 | Sacramento, CA | 523,600 | 118 | $78,954 | $467,947 | 5.9x |

| 79 | Plano, TX | 284,948 | 119 | $105,679 | $503,025 | 4.8x |

| 80 | Portland, OR | 646,101 | 121 | $85,876 | $523,622 | 6.1x |

| 81 | Jersey City, NJ | 287,899 | 123 | $91,151 | $591,988 | 6.5x |

| 82 | Riverside, CA | 316,076 | 124 | $83,448 | $606,630 | 7.3x |

| 83 | Scottsdale, AZ | 240,537 | 126 | $104,197 | $798,175 | 7.7x |

| 84 | Anchorage, AK | 290,674 | 132 | $95,731 | $373,986 | 3.9x |

| 85 | Chula Vista, CA | 276,103 | 139 | $101,984 | $809,308 | 7.9x |

| 86 | Santa Ana, CA | 311,379 | 140 | $84,210 | $753,174 | 8.9x |

| 87 | Santa Clarita, CA | 225,850 | 144 | $116,186 | $773,299 | 6.7x |

| 88 | Long Beach, CA | 462,293 | 145 | $78,995 | $799,165 | 10.1x |

| 89 | Anaheim, CA | 347,111 | 145 | $88,538 | $844,174 | 9.5x |

| 90 | New York, NY | 8,622,467 | 146 | $76,607 | $733,006 | 9.6x |

| 91 | Los Angeles, CA | 3,881,041 | 147 | $76,244 | $926,593 | 12.2x |

| 92 | Boston, MA | 665,945 | 148 | $89,212 | $714,795 | 8.0x |

| 93 | San Diego, CA | 1,383,987 | 151 | $98,657 | $955,846 | 9.7x |

| 94 | Oakland, CA | 437,825 | 154 | $94,389 | $790,956 | 8.4x |

| 95 | Seattle, WA | 734,603 | 156 | $116,068 | $827,235 | 7.1x |

| 96 | Arlington, VA | 235,845 | 164 | $137,387 | $761,141 | 5.5x |

| 97 | San Jose, CA | 1,001,176 | 180 | $136,010 | $1,330,692 | 9.8x |

| 98 | Irvine, CA | 304,527 | 184 | $122,948 | $1,331,528 | 10.8x |

| 99 | Fremont, CA | 228,795 | 186 | $169,023 | $1,413,076 | 8.4x |

| 100 | San Francisco, CA | 851,036 | 201 | $136,689 | $1,254,436 | 9.2x |

Cheapest Places By State

Cheapest Places To Live In Alaska

Cheapest Places To Live In Alabama

Cheapest Places To Live In Arkansas

Cheapest Places To Live In Arizona

Cheapest Places To Live In California

Cheapest Places To Live In Colorado

Cheapest Places To Live In Connecticut

Cheapest Places To Live In Delaware

Cheapest Places To Live In Florida

Cheapest Places To Live In Georgia

Cheapest Places To Live In Hawaii

Cheapest Places To Live In Iowa

Cheapest Places To Live In Idaho

Cheapest Places To Live In Illinois

Cheapest Places To Live In Indiana

Cheapest Places To Live In Louisiana

Cheapest Places To Live In Massachusetts

Cheapest Places To Live In Maryland

Cheapest Places To Live In Maine

Cheapest Places To Live In Michigan

Cheapest Places To Live In Minnesota

Cheapest Places To Live In Missouri

Cheapest Places To Live In Mississippi

Cheapest Places To Live In Montana

Cheapest Places To Live In North Carolina

Cheapest Places To Live In North Dakota

Cheapest Places To Live In Nebraska

Cheapest Places To Live In New Hampshire

Cheapest Places To Live In New Jersey

Cheapest Places To Live In New Mexico

Cheapest Places To Live In Ohio

Cheapest Places To Live In Oklahoma

Cheapest Places To Live In Oregon

Cheapest Places To Live In Pennsylvania

Cheapest Places To Live In Rhode Island

Cheapest Places To Live In South Carolina

Cheapest Places To Live In South Dakota

Cheapest Places To Live In Tennessee

Cheapest Places To Live In Texas

Cheapest Places To Live In Utah

Cheapest Places To Live In Virginia

Cheapest Places To Live In Vermont

Cheapest Places To Live In Washington

Cheapest Places To Live In Wisconsin